Data Quality

for Financial Services

Ensure Accurate Data for Regulatory Compliance, Fraud Detection, Customer 360, and Financial Reporting.

Book a Demo“DQLabs leads our way and is a critical part of digital and regulatory compliance strategy with its out-of-the-box augmented data quality rules that can be applied across the entire bank.”

Read Full Story77%

Reduction in

Data Quality Issues

Analyst Research

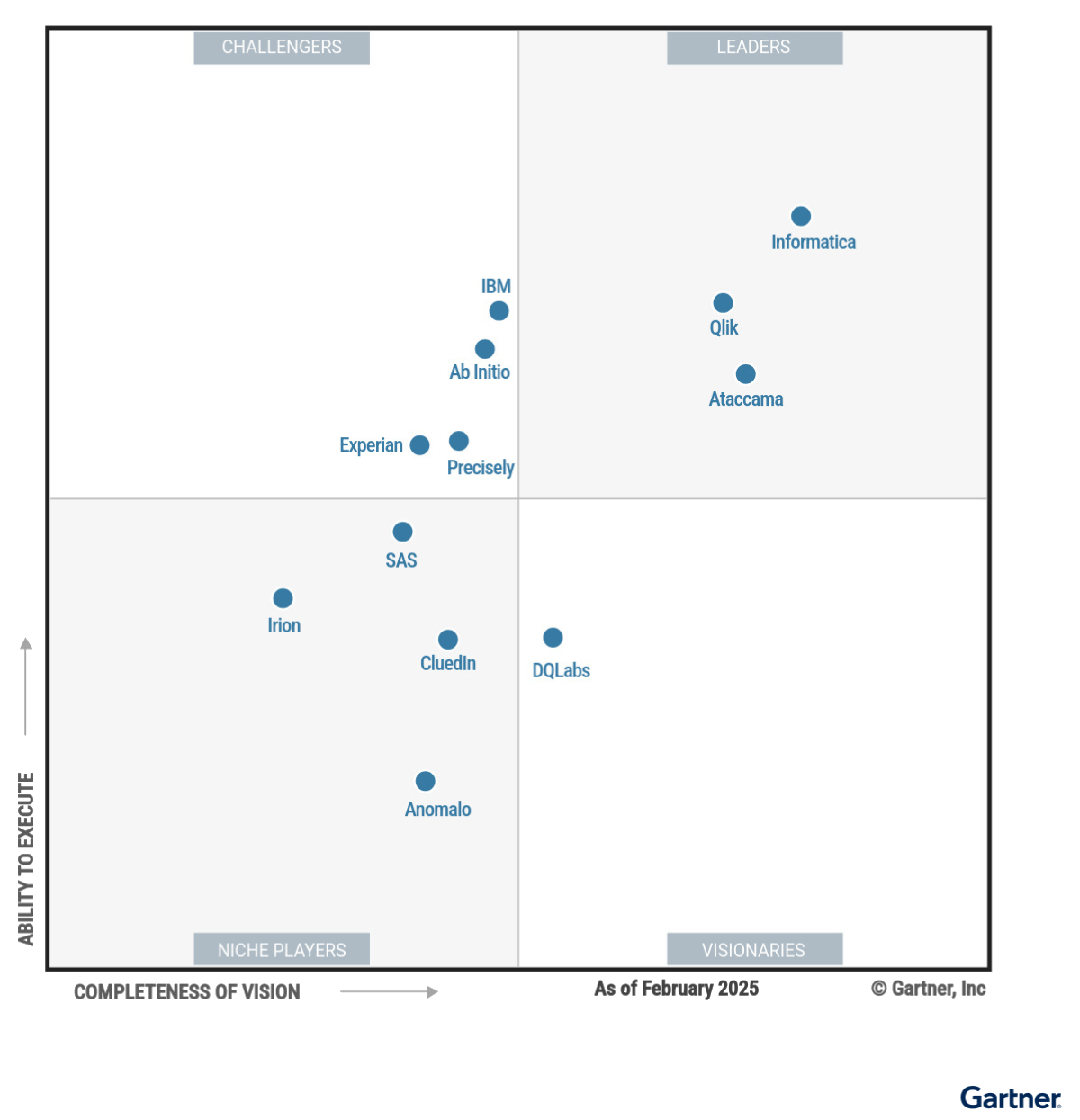

DQLabs is A Visionary in the 2025 Gartner® Magic Quadrant™ for Augmented Data Quality Solutions

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.

Transform Financial Operations with Reliable Data

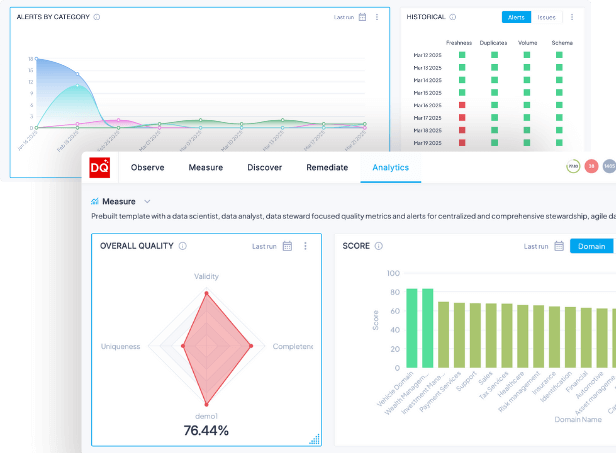

DQLabs Platform

The only unified platform that brings together Data Quality, Observability, and Discovery to ensure reliable, AI-ready data by providing in-depth insights into data health and performance.

- Agentic AI-Powered Data Quality

- End-to-End Data Observability

- AI/ML-Driven Anomaly Detection

- Self-Service Data Discovery

- Data Lineage & Governance

- Advanced Root-Cause Analysis & Insights

- Seamless Integration & Interoperability